Becoming an Actuary

Hi guys, if you’re interested in working in the actuarial field, it would be in your best interests to click on this post!

In recent years, the interest in the actuarial field has been growing exponentially among youngsters. They are mostly attracted to its many perks such as job security, high income, or even the belief that they would be working with mathematical concepts in their job.

However, most do not know that the pathway to becoming an actuary is not an easy one. It involves going through a university-level education, a series of professional examinations, practical experience and residential courses.

In Malaysia, most actuaries are from the following actuarial bodies:

- Society of Actuaries (SOA) – United States

- Casualty Actuarial Society (CAS) – United States

- Institute and Faculty of Actuaries (IFoA) – United Kingdom

- Actuaries Institute – Australia

This post will be about the SOA pathway, or more specifically, becoming an Associate of SOA.

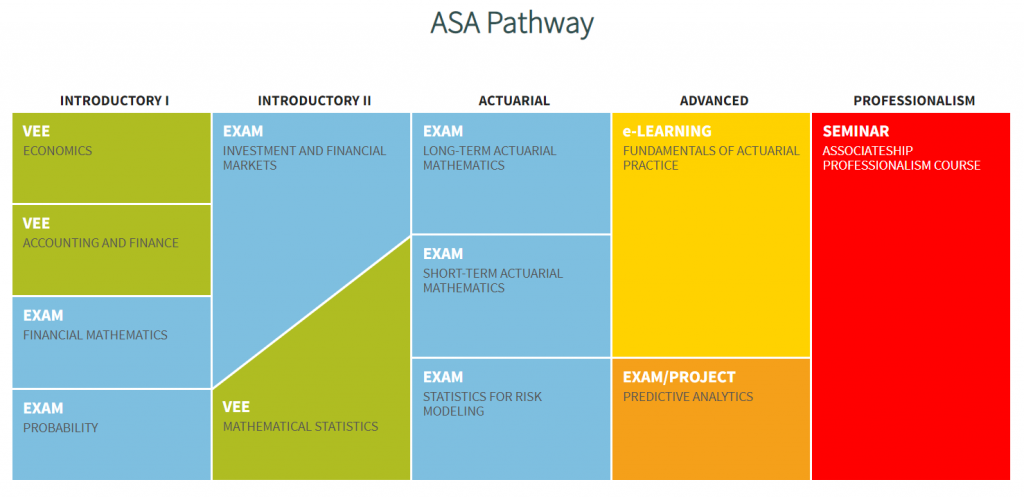

The VEE (Validation by Educational Experience) credits are needed to attain a SOA membership. As a student of UCSI University, you will receive all three VEE credits provided that you obtain a grade of B and above in relevant courses in your study and pass 2 preliminary exams.

Next are the preliminary exams. Students will spend the most time studying to pass 6 preliminary papers which include:

- Exam P (Probability): This course requires a thorough command on probability and calculus, and also a basic knowledge of insurance and risk management. The exam is 3 hours, consisting of 35 multiple-choice questions.

- Exam FM (Financial Mathematics): This course covers topics such as interest theory and derivative securities, and also a basic knowledge of probability and calculus. The exam is 3 hours, consisting of 35 multiple-choice questions.

- Exam IFM (Investment and Financial Markets): This course tests on your knowledge of the theoretical basis of corporate finance and financial models and their applications in insurance. A thorough understanding of calculus, probability (as covered in Exam P), basic corporate finance (as covered in VEE Accounting and Finance) and interest theory (as covered in Exam FM) is required. The exam is 3 hours, consisting of 35 multiple-choice questions.

- Exam LTAM (Long-Term Actuarial Mathematics): This course is about the theoretical basis of contingent payment models and the application of those models to insurance and other financial risks. A thorough knowledge of calculus, probability (as covered in Exam P), mathematical statistics (as covered in VEE Mathematical Statistics) and interest theory (as covered in Exam FM) is required. The exam is 4 hours, consisting of 20 multiple-choice questions and 7 written answer questions.

- Exam STAM (Short-Term Actuarial Mathematics): This course provides an introduction to modelling and covers important actuarial methods useful in modelling such as frequency models, severity models, aggregate models, and credibility models. A thorough knowledge of calculus, probability (as covered in Exam P) and mathematical statistics (as covered in VEE Mathematical Statistics) and a basic understanding of pricing and reserving for short-term insurance coverages are required. The exam is 3.5 hours, consisting of 35 multiple-choice questions.

- Exam SRM (Statistics for Risk Modelling): This course is about the methods and models for analysing data through methods such as regression models, time series models, principal components analysis, decision trees, and cluster analysis. A thorough knowledge of calculus, probability (as covered in Exam P) and mathematical statistics (as covered in VEE Mathematical Statistics) is required. The exam is 3.5 hours, consisting of 35 multiple-choice questions.

The Fundamentals of Actuarial Practice (FAP) modules is an e–Learning course composed of eight modules that is distributed and facilitated by electronic means.

Next is Exam PA (Predictive Analytics), which is a five-hour and 15-minute project that requires you to employ selected analytic techniques to solve business problems and effectively communicate the solution.

Lastly, you have to attend the Associateship Professionalism Course (APC), which is a half-day seminar that covers professionalism, ethics and legal liability as an actuary.

And that are basically the steps you’ll have to take in order to achieve associateship.

Sounds complicated, right? But you don’t have to worry because you don’t have to do them in order. For more detailed information, you can refer to the SOA website here.